New Delhi: On May 12, 2025, U.S. President Donald Trump signed a groundbreaking executive order aimed at slashing prescription drug prices in the United States by implementing a Most-Favored Nation (MFN) pricing model. This move, described by Trump as “one of the most consequential” executive orders in U.S. history, seeks to align U.S. drug prices with the lowest prices paid by other developed nations. The order has sparked intense debate, with potential ripple effects on the global pharmaceutical industry, including India’s significant pharma sector, and faces skepticism from experts, legal challenges, and opposition from industry groups.

What Is the Most-Favored Nation Executive Order?

The executive order directs the U.S. Department of Health and Human Services (HHS) to ensure that Medicare payments for certain drugs—specifically those administered in a doctor’s office under Medicare Part B—are tied to the lowest price paid by other economically advanced countries. Trump announced that this MFN policy would ensure that “the United States will no longer subsidize the healthcare of foreign countries,” a reference to the fact that U.S. consumers often pay two to four times more for prescription drugs than their counterparts in countries like Australia, Canada, and France.

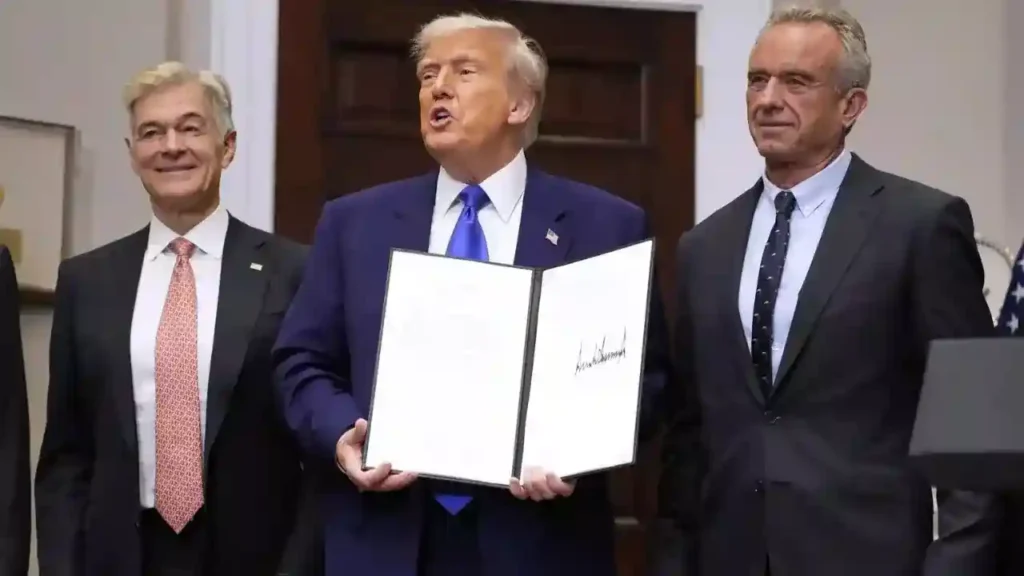

The order gives drugmakers a 30-day deadline to make “significant progress” toward aligning their prices with international benchmarks. If they fail to comply, the government may impose rulemaking to enforce international pricing levels, consider importing drugs from countries with lower prices, or implement export restrictions. Additionally, the order encourages direct-to-consumer purchasing programs to bypass insurance companies and pharmaceutical benefit managers, which Trump and his health officials, including Health Secretary Robert F Kennedy Jr., Medicare and Medicaid Administrator Mehmet Oz, and Food and Drug Administration Commissioner Martin Makary, blame for inflating costs.

Trump has claimed that the policy could reduce drug prices by 30% to 80% “almost immediately,” with potential savings in the “trillions of dollars.” However, experts, including Alan Sager, a professor of health policy at Boston University, have expressed skepticism, noting that the opacity of drug pricing allows manufacturers to claim compliance by highlighting existing discounts on high retail prices. The lack of clear enforcement mechanisms and the vague definitions of “unreasonable or discriminatory” pricing further complicate implementation.

Understanding Most-Favored Nation Status

The MFN principle, rooted in Article 1 of the General Agreement on Tariffs and Trade (GATT) 1994, is a cornerstone of the World Trade Organization’s (WTO) multilateral trading system. It mandates that WTO member countries grant the same favorable trade terms to all other members, preventing discrimination among trading partners. In the context of Trump’s order, MFN status means that drug companies would be required to offer the U.S. the lowest price they provide to any other country, either voluntarily or through federal intervention.

Trump emphasized that non-compliance could lead to punitive measures, including tariffs on imported drugs—a tactic consistent with his broader trade policy. However, the mechanism for enforcing compliance remains unclear, raising questions about the order’s feasibility.

Why Are U.S. Drug Prices So High?

The U.S. healthcare system’s complexity contributes significantly to high drug prices. Unlike many developed countries with centralized healthcare systems that negotiate blanket rates for pharmaceuticals, the U.S. relies on a fragmented system involving private insurance, employer subsidies, and public programs like Medicare and Medicaid. A 2021 U.S. Government Accounting Office report found that prescription drugs in the U.S. are, on average, two to four times more expensive than in Australia, Canada, and France.

Both Democratic and Republican politicians have long criticized these costs. Trump, during his first term, and President Joe Biden attempted to address the issue, particularly for life-saving drugs like insulin, but progress has been limited due to pharmaceutical lobbying and legal challenges. Trump’s health officials have pointed to the industry’s influence, with Trump himself calling the drug lobby “the strongest lobby” during a White House briefing on May 12.

Potential Impacts on the U.S. Healthcare System

The executive order primarily targets Medicare Part B, which covers drugs administered in doctor’s offices, such as cancer infusions and other injectables. Medicare Part B drug spending reached $33 billion in 2021, and a Trump administration report from his first term noted that the U.S. spends twice as much as other countries on these drugs. Beneficiaries often bear significant out-of-pocket costs for these medications, with no annual cap for traditional Medicare enrollees.

If successful, the order could reduce costs for the government and patients, particularly for the 70 million older Americans covered by Medicare. However, its scope is limited to Medicare Part B drugs, meaning common prescription drugs filled at pharmacies are unlikely to be affected. Additionally, Trump’s claim of “trillions” in savings is widely regarded as an exaggeration.

The order also directs the Federal Trade Commission (FTC) to investigate anti-competitive practices by drugmakers, such as deals with generic companies to delay cheaper alternatives’ market entry. FTC spokesperson Joe Simonson stated that the agency would be a “proud partner” in this effort, building on its history of antitrust enforcement in the pharmaceutical sector.

Challenges and Industry Opposition

The executive order faces significant hurdles. Industry groups, including the Pharmaceutical Research and Manufacturers of America (PhRMA) and the Biotechnology Innovation Organization, have strongly opposed the move. PhRMA President Stephen J. Ubl argued that importing foreign prices from “socialist countries” would harm American patients by reducing access to treatments and jeopardizing investment in new drugs. John F. Crowley, president of the Biotechnology Innovation Organization, called the MFN policy a “deeply flawed proposal” that could devastate small- and mid-size biotech companies by limiting research funding.

Legal challenges are also likely. Health policy lawyer Paul Kim noted that the order’s suggestions, such as broader drug importation, may exceed U.S. statutory limits. A similar executive order signed by Trump in 2020 was blocked by a court under the Biden administration, and experts like Lawrence Gostin, a professor of health law at Georgetown Law, predict a “flood of litigation” once concrete enforcement actions are taken.

Market reactions reflect skepticism about the order’s immediate impact. Shares of major drugmakers, including Pfizer, Merck & Co, Gilead Sciences, and Eli Lilly, initially fell but rallied on May 12, closing up significantly. Analysts, such as Evan Seigerman from BMO Capital Markets, noted that the order lacks detailed plans for price cuts, and previous attempts to implement MFN pricing were halted by courts.

Global Implications: Impact on India’s Pharmaceutical Sector

The executive order could have far-reaching consequences for India, which accounts for nearly one-third of its $10 billion annual pharmaceutical exports to the U.S. The proposed price cuts could reduce profits for Indian pharma companies, potentially limiting funds for research and development of new medicines. To offset these losses, companies may seek higher prices in domestic markets like India, which could increase healthcare costs for Indian consumers.

India’s pharmaceutical industry, a key player in the global generic drug market, operates under the WTO’s MFN framework, which ensures non-discriminatory trade practices. However, the U.S.’s unilateral push for MFN pricing could strain trade relations, particularly if Trump’s proposed tariffs on imported drugs are implemented.

Broader Policy Context and Public Sentiment

The executive order aligns with Trump’s campaign promises to tackle inflation and lower costs for everyday items, from gas to medications. High drug prices remain a top concern for Americans, with polls consistently showing dissatisfaction with the U.S. healthcare system. Trump’s narrative of American consumers being “suckers” who bear the burden of global drug costs resonates with this sentiment.

However, the order’s alignment with Health Secretary Robert F. Kennedy Jr.’s “Make America Healthy Again” agenda, which emphasizes diet and exercise over pharmaceutical interventions, is unclear. Kennedy has criticized the proliferation of certain drugs, including vaccines and mental health medications, which could complicate the administration’s approach to drug pricing reforms.

Expert Perspectives and Future Outlook

Experts like C. Michael White, a pharmacy professor at the University of Connecticut, view the order as a positive step toward transparency and lower costs but caution that its impact will be “minimal” for many Americans. Researchers Darius Lakdawalla and Dana Goldman from the University of Southern California warn that drug companies might withdraw from markets with lower prices to protect U.S. profits, potentially disrupting global drug supply chains. They also argue that adopting a European pricing model could lead to “shorter, less healthy lives for Americans” by undervaluing drugs’ benefits.

The order’s success hinges on sustained political will and the administration’s ability to navigate legal and industry opposition. Professor Sager suggested that alternative funding models, such as cash prizes for developing cures, could support research without relying on high drug prices. However, he questioned whether Trump would maintain focus on the issue given his “apparent public vacillation on many topics.”

Conclusion

President Trump’s executive order on Most-Favored Nation drug pricing represents a bold attempt to address the persistent issue of high prescription drug costs in the U.S. By targeting Medicare Part B drugs and aligning prices with international benchmarks, the order aims to deliver savings for the government and patients. However, its vague enforcement mechanisms, limited scope, and fierce opposition from the pharmaceutical industry raise doubts about its effectiveness. The potential impact on global markets, particularly India’s pharmaceutical sector, adds another layer of complexity. As legal challenges and industry pushback loom, the order’s fate—and its ability to deliver on Trump’s promise of transformative cost reductions—remains uncertain.