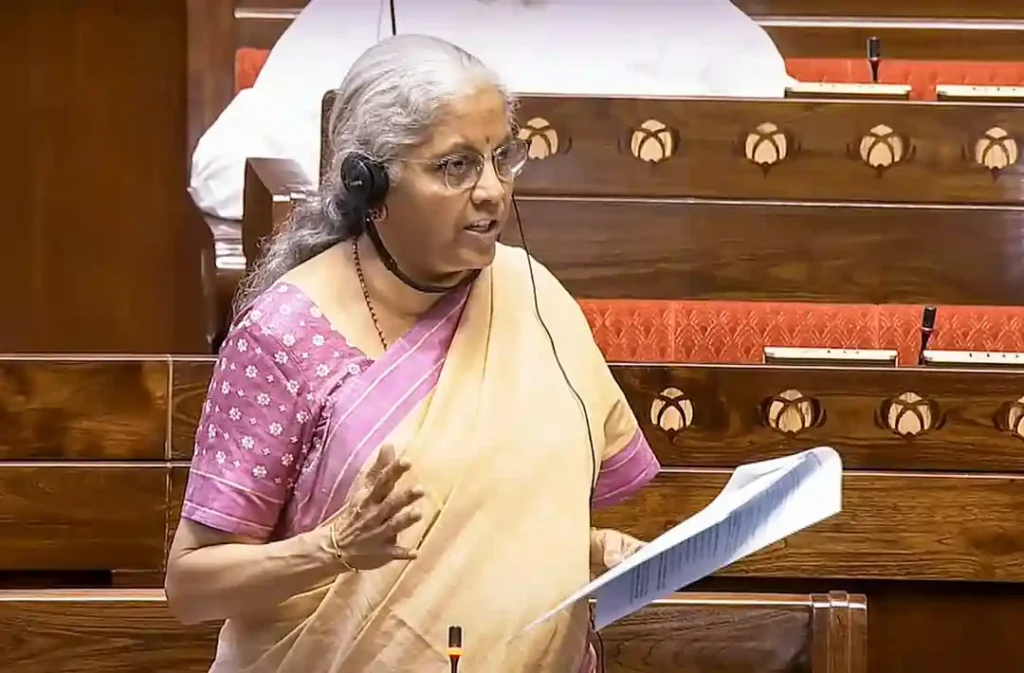

New Delhi: In a landmark move to modernize India’s tax framework, the Lok Sabha passed the Taxation Laws (Amendment) Bill, 2025, and the Income-Tax (No.2) Bill, 2025, on August 11, 2025, through a voice vote. The bills, introduced by Union Finance Minister Nirmala Sitharaman, aim to simplify, consolidate, and amend the Income Tax Act, 1961, and the Finance Act, 2025. The passage occurred amidst significant disruptions by opposition members protesting issues such as the Special Intensive Revision exercise in Bihar and alleged electoral malpractices.

Income-Tax (No.2) Bill, 2025: Simplifying a Complex Legacy

The Income-Tax (No.2) Bill, 2025, addresses the complexities that have accumulated over six decades in the Income Tax Act, 1961, which have reduced administrative efficiency and burdened taxpayers. The new legislation seeks to modernize and streamline tax processes, making compliance easier for individuals and businesses. Key features of the bill include:

- Extended Deductions: Deductions under section 80M (Clause 148 of the IT Bill, 2025) are now available to companies opting for the new tax regime. Additionally, Clause 93 extends deductions for commuted pension and gratuity to family members, enhancing benefits for non-employees receiving pensions from funds.

- MAT and AMT Reforms: The provisions for Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT) are separated into two subsections under section 206. AMT applies only to non-corporates claiming deductions, while Limited Liability Partnerships (LLPs) with only capital gains income are exempt from AMT if no deductions are claimed.

- Digital Economy Support: Clause 187 mandates electronic payment modes for professionals with receipts exceeding ₹50 crore, adding “profession” to existing business provisions to bolster the digital economy.

- Simplified Language and Definitions: The bill introduces easier drafting, improved cross-referencing, and updated definitions for terms like “capital asset,” “micro and small enterprises,” and “beneficial owner,” ensuring clarity and accessibility.

- Flexible Refund Claims: The removal of Clause 263(1)(ix) allows refund claims even when returns are not filed on time, enhancing taxpayer flexibility.

Taxation Laws (Amendment) Bill, 2025: New Exemptions and Reforms

The Taxation Laws (Amendment) Bill, 2025, amends the Income Tax Act, 1961, and the Finance Act, 2025, to introduce new exemptions and benefits. Key reforms include:

- Unified Pension Scheme (UPS): Tax exemptions are aligned with those of the New Pension Scheme, ensuring consistency in pension-related benefits.

- Foreign Investment Relief: Direct tax relief is provided to the Public Investment Fund of Saudi Arabia and its subsidiaries, encouraging foreign investment.

- Streamlined Search Cases: The bill simplifies the treatment of pending assessments and reassessments in block assessment procedures, reducing administrative bottlenecks.

Legislative Journey and Select Committee Recommendations

The Income-Tax (No.2) Bill, 2025, was introduced in the Lok Sabha on February 13, 2025, following a six-month simplification exercise, marking it as a significant reform in India’s direct tax code. The bill was referred to a Select Committee, chaired by Baijayant Panda, which submitted its report on July 21, 2025. The government accepted nearly all of the committee’s recommendations, leading to the withdrawal of the original Income-tax Bill, 2025, to incorporate corrections and introduce the Income-Tax (No.2) Bill, 2025.

The Select Committee flagged multiple drafting errors and proposed amendments to enhance clarity and fairness:

- Clause 21 (Annual Value of Property): Removed the ambiguous term “in normal course” and clarified comparisons between actual rent and “deemed rent” for vacant properties.

- Clause 22 (House Property Income Deductions): Specified that the 30% standard deduction applies after deducting municipal taxes and extended pre-construction interest deductions to let-out properties.

- Clause 19 (Salary Deductions – Schedule VII): Allowed commuted pension deductions for non-employees receiving pensions from funds.

- Clause 20 (Commercial Property): Modified wording to prevent taxing temporarily unused business properties as “house property” income.

These changes align the law with existing provisions, reduce ambiguity, and promote fairness.

Context of Passage: Opposition Disruptions

The bills were passed without debate due to the absence of opposition members during their introduction, as many were detained while marching to the Election Commission headquarters to protest the revision of Bihar’s electoral rolls and alleged malpractices. Upon their return, opposition members raised slogans and held placards in the Well of the House, creating a noisy atmosphere. Despite this, the bills were approved by voice vote.

Speaker Om Birla criticized the opposition for disrupting proceedings for 14 consecutive days, stating that such actions were against parliamentary rules and democratic processes. He emphasized that elected representatives are meant to address public issues, not merely protest. The Lok Sabha adjourned till 2 p.m. after a brief attempt to conduct Question Hour.

Parliamentary Affairs Minister Kiren Rijiju targeted the Congress-led opposition for repeated disruptions, asserting that the government would proceed with passing key bills. He listed the Income Tax Bill, National Sports Governance Bill, Merchant Shipping Bill, National Anti-Doping (Amendment) Bill, and Manipur Goods and Services Tax (Amendment) Bill as priorities. Rijiju urged constructive discussions but condemned repetitive protests on the same issue, calling them a waste of parliamentary time.

Broader Legislative Activity

In addition to the tax bills, the Lok Sabha passed the National Anti-Doping (Amendment) Bill, 2025, and the National Sports Governance Bill, 2025, also by voice vote, without opposition presence initially. Union Minister for Youth Affairs and Sports Mansukh Mandaviya highlighted the importance of robust, transparent, and accountable sports governance, especially as India prepares to bid for the Olympics. The Rajya Sabha returned the Manipur Budget Bill in the opposition’s absence, and on August 12, 2025, Parliament approved the Merchant Shipping Bill, 2025.

Rajya Sabha Approval and Historical Context

On August 12, 2025, the Rajya Sabha approved the Income-Tax (No.2) Bill, 2025, and the Taxation Laws (Amendment) Bill, 2025, by voice vote, following the Lok Sabha’s approval. Finance Minister Sitharaman explained that parts of the 1961 Income Tax Act had become outdated, necessitating new legislation to modernize tax laws for individuals and corporations.

The withdrawn February draft of the Income-tax Bill, 2025, was described as the most significant reform of India’s direct tax code in over 60 years. It featured simplified language, consolidated deductions, shorter provisions, lower penalties for certain offenses, and a “trust first, scrutinize later” approach to reduce litigation. The draft included 23 chapters, 536 sections, and 16 schedules, using tables and formulas for clarity. It streamlined Tax Deducted at Source (TDS) rules, simplified depreciation provisions, and retained residency criteria and financial year timelines. The new bill clarifies laws on income from house property, building on these foundations.

Implications and Future Outlook

The passage of these bills marks a continuation of tax reforms initiated since 2014, including corporate and personal income tax reforms, capital gains taxation changes, and trust provision mergers. The government has prioritized efficiency, transparency, and taxpayer-friendliness in tax administration. Experts anticipate that the simplified language, digital economy support, and foreign investment relief will reduce compliance burdens and foster economic growth.

The bills’ approval amidst political turbulence underscores the government’s determination to advance its legislative agenda. However, the opposition’s focus on electoral issues in Bihar highlights broader democratic concerns. As India evolves its fiscal and governance frameworks, the 2025 tax bills represent a pivotal step toward a modern, user-friendly tax system, benefiting companies, professionals, and investors.

Frequently Asked Questions (FAQs)

1. What are the main objectives of the Income-Tax (No.2) Bill, 2025?

The Income-Tax (No.2) Bill, 2025, aims to simplify and modernize the Income Tax Act, 1961, which has become complex and cumbersome due to over six decades of amendments. The bill seeks to streamline tax processes, enhance administrative efficiency, and make compliance easier for taxpayers. Key features include simplified language, updated definitions (e.g., “capital asset,” “micro and small enterprises”), extended deductions for companies and family members, and support for the digital economy by mandating electronic payments for professionals with receipts exceeding ₹50 crore.

2. What changes does the Taxation Laws (Amendment) Bill, 2025 introduce?

The Taxation Laws (Amendment) Bill, 2025, amends the Income Tax Act, 1961, and the Finance Act, 2025, to provide new tax exemptions and benefits. It aligns tax exemptions for the Unified Pension Scheme (UPS) with the New Pension Scheme, offers direct tax relief to the Public Investment Fund of Saudi Arabia and its subsidiaries to encourage foreign investment, and streamlines procedures for pending assessments in search cases through block assessment methods.

3. How do the bills address deductions and tax provisions for businesses and individuals?

The Income-Tax (No.2) Bill, 2025, extends deductions under section 80M (Clause 148) to companies in the new tax regime and provides family pension and gratuity deductions under Clause 93. It separates Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT) provisions, applying AMT only to non-corporates claiming deductions. Limited Liability Partnerships (LLPs) with only capital gains income are exempt from AMT if no deductions are claimed. Additionally, refund claim flexibility is improved by removing Clause 263(1)(ix).

4. Why were these bills passed without debate in the Lok Sabha?

The bills were passed without debate on August 11, 2025, due to the absence of opposition members during their introduction, as many were detained while protesting at the Election Commission over Bihar’s electoral roll revisions and alleged malpractices. Despite their return and subsequent protests with slogans and placards, the bills were approved by voice vote amid disruptions, as the government prioritized advancing its legislative agenda.

5. What role did the Select Committee play in shaping the Income-Tax (No.2) Bill, 2025?

The Select Committee, chaired by Baijayant Panda, reviewed the original Income-tax Bill, 2025, introduced on February 13, 2025, and submitted its report on July 21, 2025. It recommended corrections to drafting errors and ambiguities, such as clarifying property income calculations (Clause 21), specifying house property deductions (Clause 22), allowing pension deductions for non-employees (Clause 19), and preventing misclassification of commercial properties (Clause 20). The government accepted nearly all recommendations, leading to the withdrawal of the original bill and the introduction of the Income-Tax (No.2) Bill, 2025.