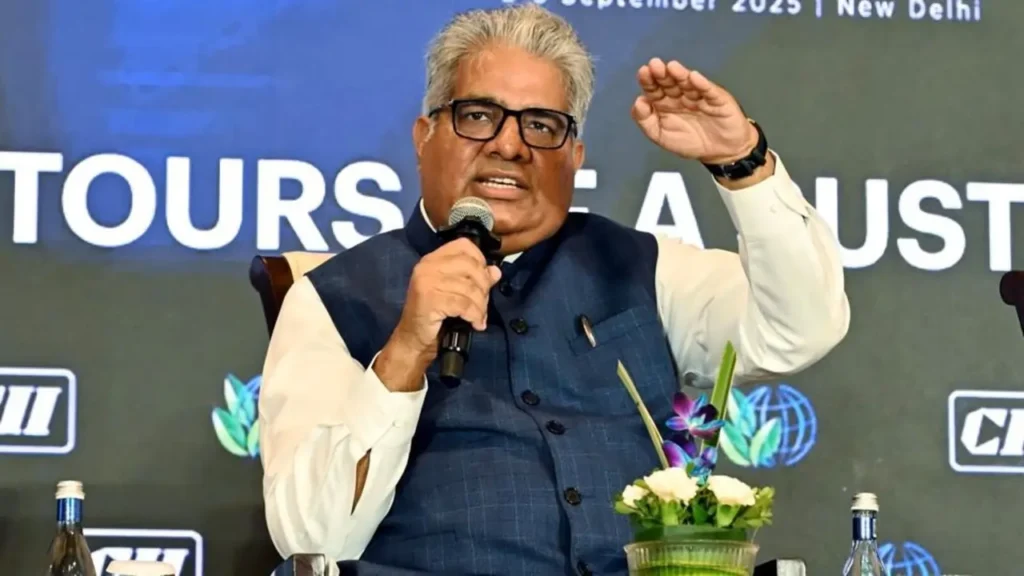

New Delhi: Union Minister for Environment, Forest, and Climate Change Bhupender Yadav has declared green finance the cornerstone of India’s journey toward a resilient and competitive economy, as the nation braces for a $10 trillion investment marathon to achieve net-zero emissions by 2070. Speaking at the Federation of Indian Chambers of Commerce & Industry’s (FICCI) LEADS 2025 conference, Yadav framed green finance as more than funding eco-projects—it’s a seismic shift in how capital flows, ensuring every investment fuels sustainability while delivering economic dividends. With the UN Climate Conference (COP30) looming in Belem, Brazil, this November, his words signal India’s bold stance on the global stage.

What is Green Finance? A Blueprint for Survival

Green finance is the lifeblood of projects that marry economic growth with environmental stewardship: sprawling solar arrays, energy-efficient skyscrapers, sustainable transport networks, and climate-smart farms. It’s about redirecting capital to ensure every rupee spent strengthens the planet’s defenses against climate chaos. Yadav underscored its role in meeting India’s ambitious emission targets, fortifying national security through clean energy, and positioning the country as a global hub for green industries.

The stakes are colossal. A 2023 Reserve Bank of India (RBI) estimate pegs the cost of adapting industries to climate norms at ₹85.6 trillion ($1.05 trillion) by 2030, with the total bill for net-zero by 2070 exceeding $10 trillion. Beyond economics, green finance promises a job bonanza—7.3 million green jobs by 2027-28, soaring to 35 million by 2047. These roles span cutting-edge renewable tech to grassroots reforestation, weaving opportunity into sustainability. Environmental wins, disaster resilience, and a just transition for fossil-dependent workers are added boons.

Yet, the path is fraught. Regulatory inconsistencies, with energy as a concurrent subject, create a policy patchwork across states. Financial institutions lack deep expertise in Environmental, Social, and Governance (ESG) frameworks, stalling deals. Financing costs sting: a 100 MW solar project in India faces interest rates of 10.0-11.5%, compared to 2.8% in Germany or 5.3% in the U.S. India’s green bond issuances, at $21 billion through 2023, are a drop in the bucket against the 500 GW renewable energy goal by 2030.

Global Inequity: A Call for the North to Step Up

Yadav didn’t mince words on global responsibility. The Industrial Revolution, sparked 200 years ago, set the stage for today’s climate crisis, with developed nations reaping early gains while the Global South bears the brunt. The UNFCCC’s $300 billion annual pledge by 2035, he argued, is a paltry gesture against the crisis’s scale. “The Global North has a moral duty to support us,” he said, pointing to mechanisms like the Green Climate Fund (GCF), where rich nations vowed $100 billion yearly by 2020 for low-carbon transitions, and the Special Climate Change Fund (SCCF), fueling adaptation, tech transfers, and capacity-building in energy and transport.

India is forging ahead domestically. The Green Social, Sustainability, and Sustainability-Linked (GSSS) bonds framework—encompassing green, yellow (solar), and blue (marine) bonds—channels funds to diverse eco-initiatives. The Climate Change Finance Unit (CCFU) under the Ministry of Finance steers these efforts, ensuring alignment with national climate goals.

India’s Three-Pronged Charge: Modi’s Vision in Action

Yadav outlined a strategic triad under Prime Minister Narendra Modi’s leadership. First, climate finance is development finance—clean power, efficient cities, and resilient agriculture aren’t add-ons but the foundation of energy, food, and industrial security. Second, early green investors will dominate future value chains, from green hydrogen to circular economies. Third, developed nations must amplify their financial commitments to level the playing field.

India’s sovereign green bonds have already won global trust, drawing hefty international investment. The RBI and SEBI are tightening transparency in green instruments, while blended finance—melding public and private funds—de-risks bold projects. Yadav acknowledged fiscal limits: “Public budgets can’t do it alone. They must set rules, reduce risks, and unlock private capital.” Here, innovation shines—fintech, digital platforms, and AI are making green finance faster, clearer, and scalable.

The Green Credit Programme, launched in October 2023 and revamped on August 29, 2025, is a game-changer. It invites private players to restore degraded lands, mandates measurable eco-outcomes, and aligns with Article 6 of the Paris Agreement, which enables global carbon market cooperation. Article 6.2 facilitates bilateral or multilateral trades of Internationally Transferred Mitigation Outcomes (ITMOs), letting countries exceeding their Nationally Determined Contributions (NDCs) sell surplus reductions to others, unlocking finance and tech. Article 6.4’s UN-overseen carbon market ensures high-quality credits, rooted in transparent baselines and rigorous adjustments.

Industry’s Rallying Cry: Bridging the Finance Gap

FICCI President Harsha Vardhan Agarwal highlighted a stark disparity: global green investments hit $1.8 trillion in 2023, but emerging economies like India got less than a quarter. This gap threatens climate pledges at a critical juncture. Yet, Indian firms are stepping up, issuing green bonds for Rajasthan solar parks and building recycling ecosystems in automotive chains, proving sustainability and profitability can coexist.

Yadav emphasized the human core of green finance: “It’s about people—creating decent jobs, protecting the vulnerable, and expanding access.” A just transition isn’t rhetoric; it’s a design imperative, reskilling workers and shielding communities from climate shocks.

COP30 and Beyond: A Moral and Economic Imperative

With COP30 approaching, Yadav’s address sets the tone for India’s demands. Predictable policies, bankable projects, and credible metrics are drawing investors, but the scale demands collaboration across governments, industries, and citizens. “A failure to fund this transition is a moral betrayal,” he warned, “locking future generations into climate chaos, resource scarcity, and degradation.”

India’s path is clear: green finance isn’t a niche—it’s the backbone of a future where profits align with planetary health. From green hydrogen to climate-resilient cities, the opportunities are vast, promising millions of jobs and a secure energy future. As Yadav put it, “Countries mobilizing green investments today will own tomorrow’s value chains.” For India, that’s not just a strategy—it’s a legacy.

FAQs

1. What is green finance, and why did Bhupender Yadav call it the backbone of resilient economies?

Green finance refers to investments in projects that promote environmental sustainability, such as renewable energy (solar, wind), energy-efficient buildings, sustainable transport, and climate-smart agriculture. At FICCI’s LEADS 2025 conference on September 11, 2025, Union Minister Bhupender Yadav emphasized that green finance restructures capital flows to ensure every investment delivers economic returns while bolstering environmental health. He called it the backbone of resilient economies because it supports India’s $10 trillion net-zero goal by 2070, enhances national security through clean energy, creates millions of green jobs (7.3 million by 2027-28, 35 million by 2047), and positions India as a leader in future green industries.

2. What are the major challenges India faces in scaling up green finance?

India’s green finance journey faces several hurdles, as outlined by Yadav. Regulatory barriers and policy inconsistencies, due to energy being a concurrent subject, create uneven implementation across states. Financial institutions often lack expertise in Environmental, Social, and Governance (ESG) frameworks, slowing investment decisions. High financing costs are a significant issue—a 100 MW solar project in India incurs interest rates of 10.0-11.5%, compared to 2.8% in Germany and 5.3% in the U.S. Additionally, India’s green bond issuances ($21 billion until 2023) are insufficient to meet the 500 GW renewable energy target by 2030, highlighting a financing gap.

3. How is India advancing green finance through domestic and global initiatives?

India is leveraging multiple strategies. Domestically, the Green Social, Sustainability, and Sustainability-Linked (GSSS) bonds framework—covering green, yellow (solar), and blue (marine) bonds—channels funds to eco-projects. The Climate Change Finance Unit (CCFU) under the Ministry of Finance coordinates these efforts. The Green Credit Programme, launched in October 2023 and updated on August 29, 2025, encourages private participation in eco-restoration with measurable outcomes. Globally, India engages with the Green Climate Fund (GCF), targeting $100 billion annually from developed nations, and the Special Climate Change Fund (SCCF) for adaptation and technology transfers. Yadav also highlighted Article 6 of the Paris Agreement, enabling carbon market trades to unlock finance and technology.

4. Why does Yadav believe developed nations have a moral responsibility to support green finance in India?

Yadav stressed that the climate crisis stems from 200 years of industrial activity led by developed nations, starting with the Industrial Revolution. This historical imbalance places a moral duty on the Global North to support the Global South, where nations like India face disproportionate climate impacts. He criticized the UNFCCC’s $300 billion annual pledge by 2035 as inadequate, arguing that richer countries must scale up commitments to fund low-carbon transitions and adaptation in developing nations, ensuring equity in the global fight against climate change.

5. How does green finance align with job creation and India’s economic goals?

Green finance is a catalyst for economic and social transformation. Yadav highlighted its potential to create 7.3 million green jobs by 2027-28 and 35 million by 2047, spanning renewable energy, sustainable agriculture, and green infrastructure. These jobs range from high-tech roles in green hydrogen to community-driven reforestation efforts. By investing in sectors like solar, wind, and climate-resilient infrastructure, India aims to secure energy and food security, enhance industrial competitiveness, and lead global green value chains. Yadav emphasized that green finance ensures a just transition, protecting vulnerable workers while aligning profitability with planetary health.