New Delhi: In a powerful testament to India’s fight against financial crime, the Enforcement Directorate (ED) announced on September 15, 2025, that it has achieved a conviction rate exceeding 94% in cases prosecuted under the Prevention of Money Laundering Act (PMLA). Out of 53 cases adjudicated in special courts, the agency secured convictions in 50, marking a near-unassailable success rate. Beyond courtroom victories, the ED has facilitated the restitution of over ₹34,000 crore to victims and legitimate claimants, underscoring its dual role as both enforcer and restorer. With a bold target of returning ₹15,000 crore to victims this financial year, the agency is intensifying its focus on emerging threats like cyber-fraud and online betting, as outlined during its landmark 32nd quarterly conference in Srinagar, Jammu & Kashmir, held from September 12 to 13, 2025.

A Triumph in Numbers: 94% Conviction Rate and ₹34,000 Crore Restored

The ED’s 94%+ conviction rate in PMLA cases is a milestone that positions it among the world’s most effective anti-money laundering agencies. The Prevention of Money Laundering Act, 2002, empowers the ED to target assets derived from criminal activities tied to predicate offenses such as corruption, fraud, or drug trafficking. In 50 out of 53 cases, the agency’s meticulous investigations culminated in convictions, reflecting the strength of its evidence-gathering and prosecutorial processes.

Equally significant is the ED’s role in victim restitution. By restoring assets worth over ₹34,000 crore, the agency has delivered tangible relief to those defrauded in high-profile scams, notably the Sahara case, where investigative breakthroughs unlocked significant recoveries. This financial year, the ED has set an ambitious goal of restituting ₹15,000 crore, a target that reflects both its growing efficiency and the increasing scale of financial crimes it confronts.

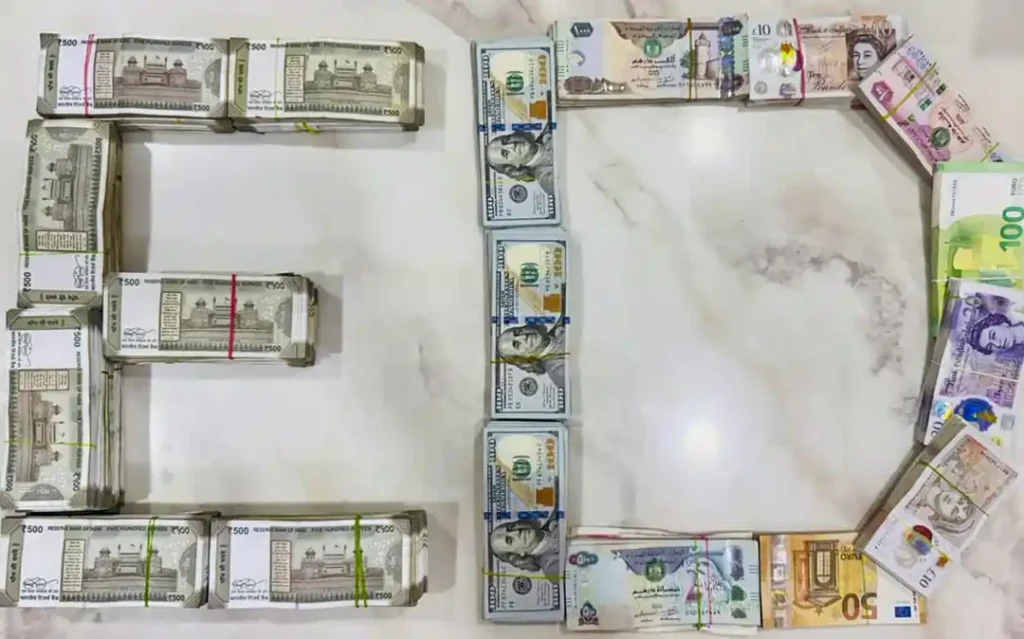

These achievements highlight the PMLA’s effectiveness as a legal framework and the ED’s pivotal role in not only punishing offenders but also compensating victims. The agency’s ability to trace and seize illicit assets—evidenced by a dramatic August 23, 2025, operation that uncovered cash hoards in an illegal betting probe—demonstrates its operational muscle and commitment to dismantling criminal financial networks.

Srinagar Summit: Strategic Roadmap in a Symbolic Setting

The ED’s 32nd quarterly conference, held in Srinagar from September 12 to 13, 2025, was a pivotal moment for aligning strategy and showcasing resilience. Chaired by ED Director Rahul Navin and attended by Special Directors, Additional Directors, Joint Directors, and Deputy/Assistant Legal Advisors, the summit addressed pressing operational and judicial priorities. The choice of Srinagar as the venue carried profound significance. Following a tragic terrorist attack in Pahalgam earlier in 2025, hosting the conference in Jammu & Kashmir’s summer capital was a deliberate move to restore confidence in the region’s security and vibrancy. The ED’s statement hailed the event’s success as proof that J&K remains a “safe, vibrant, and forward-looking venue” for national and international gatherings.

A central focus of the summit was accelerating PMLA trials, a response to recent Supreme Court observations during its review of the Vijay Madanlal Chaudhary judgment, which criticized the agency’s broader conviction rates across its caseload. Director Navin reviewed case statistics and issued directives to zonal heads to expedite pending investigations, file final prosecution complaints promptly, and prioritize trial fast-tracking. To address judicial bottlenecks, the ED has sent letters to the Registrars of all Chief Justices, proposing the establishment of exclusive PMLA courts to streamline adjudications.

The conference also spotlighted technological upgrades. The ED’s internal case management system was scrutinized, with a mandate to complete data entry within a month to enhance operational transparency. However, challenges persist, particularly post-Chaudhary ambiguities in defining “exceptional cases” for taking possession of attached properties. The agency is working to seize confirmed assets to prevent offenders from profiting, while revised rules are being drafted to clarify these processes.

Tackling Emerging Threats: Cyber-Fraud, Online Betting, and Legal Conflicts

The Srinagar summit devoted significant attention to emerging challenges, particularly in the digital realm. Following the Union government’s recent ban on real-money online gaming, the ED announced “focused strategies” to investigate money laundering through these platforms. The agency is also strengthening its approach to cyber-fraud and online betting, domains where technological sophistication is outpacing traditional investigative methods. Existing cases in these areas were praised for their robustness, with a directive to standardize investigative protocols for scalability.

Legal and procedural conflicts pose another hurdle. The interplay between the PMLA and the Insolvency and Bankruptcy Code (IBC) has created friction, as insolvency proceedings can inadvertently shield laundered assets. The ED is collaborating with the Insolvency and Bankruptcy Board of India (IBBI) to develop coordinated guidelines and is addressing legacy National Company Law Tribunal (NCLT) cases to prevent misuse of IBC provisions. These efforts aim to ensure that laundering probes remain unhindered by competing legal frameworks.

The summit also addressed Foreign Exchange Management Act (FEMA) enforcement, with Navin urging officials to pursue these cases with “greater seriousness” and expedite closures of pending adjudications under the repealed Foreign Exchange Regulation Act (FERA). Senior officers were reminded to uphold “preventive vigilance” and adhere to the ED’s core values of integrity, accountability, commitment, and excellence.

Challenges on the Horizon: Backlogs and Systemic Strains

Despite its successes, the ED faces significant challenges. The 94% conviction rate, while impressive, is based on a small sample of 53 completed cases, raising concerns about the agency’s capacity to address a larger backlog of pending investigations. Over the past decade, the ED filed closure reports in 49 PMLA cases, indicating a pragmatic approach to unviable probes but underscoring the need for broader judicial capacity.

The interdependence of PMLA prosecutions on predicate offense outcomes adds complexity. Delays or acquittals in underlying cases—such as corruption or fraud—can derail laundering trials, a dynamic the ED is working to mitigate. Additionally, the agency is revising operational manuals and circulars to adapt to evolving threats and ensure procedural agility.

The ED’s Mandate: A Legacy of Enforcement

Established in 1956 under the Department of Revenue, Ministry of Finance, and headquartered in Delhi, the ED has evolved into a formidable force against economic offenses. Its mandate spans three key laws:

- Prevention of Money Laundering Act, 2002 (PMLA): A criminal law targeting money laundering and enabling asset confiscation.

- Foreign Exchange Management Act, 1999 (FEMA): A civil law addressing violations of foreign exchange regulations.

- Fugitive Economic Offenders Act, 2018 (FEOA): A statute designed to deter economic offenders from evading Indian jurisdiction by confiscating their domestic assets.

Armed with powers to conduct searches, seizures, summons, arrests, and prosecutions, the ED operates with precision and authority. Its August 2025 betting case raids, which unearthed significant cash seizures, exemplify its capacity to disrupt illicit financial flows.

Looking Ahead: A Victim-Centric, Tech-Forward Future

The ED’s achievements—94% convictions and ₹34,000 crore in restitutions—signal a victim-centric approach that blends punishment with reparation. The ₹15,000 crore restitution target for 2025-26 reflects confidence in scaling these efforts. However, overcoming judicial backlogs, harmonizing PMLA with IBC, and countering tech-driven crimes like online betting will test the agency’s adaptability.

The Srinagar summit’s success, set against J&K’s complex backdrop, reinforces the ED’s role as both an enforcement powerhouse and a symbol of institutional resilience. As it navigates cyber threats, legal intricacies, and systemic pressures, the Enforcement Directorate is poised to redefine economic justice in India, ensuring that ill-gotten wealth returns to those it rightfully belongs to.

Frequently Asked Questions

1. What is the significance of the Enforcement Directorate’s 94% conviction rate under the PMLA?

The Enforcement Directorate (ED) achieved a conviction rate of over 94% in 53 cases prosecuted under the Prevention of Money Laundering Act (PMLA), securing convictions in 50 cases. This high success rate demonstrates the effectiveness of the ED’s investigative processes and the robustness of the PMLA as a legal framework for combating money laundering. It underscores the agency’s ability to build strong cases against financial criminals, positioning it as a global leader in anti-money laundering enforcement. Additionally, this milestone enhances public trust in the ED’s mission to not only punish offenders but also recover illicit assets for victims.

2. How has the ED contributed to victim restitution, and what is its target for the current financial year?

The ED has facilitated the restitution of over ₹34,000 crore to victims and legitimate claimants defrauded in various financial scams, with notable progress in the Sahara case. This reflects the agency’s commitment to restoring assets to those affected by economic crimes, a key provision of the PMLA. For the 2025-26 financial year, the ED has set an ambitious target of restituting ₹15,000 crore, signaling its intent to scale up asset recovery efforts and deliver tangible justice to victims of financial fraud.

3. What challenges does the ED face in maintaining its high conviction rate and achieving its goals?

Despite its 94% conviction rate, the ED faces several challenges. The high rate is based on a small sample of 53 completed cases, while a larger backlog of pending investigations raises concerns about systemic efficiency. Conflicts between the PMLA and the Insolvency and Bankruptcy Code (IBC) create procedural hurdles, as insolvency processes can shield laundered assets. Additionally, the ED is grappling with technologically advanced crimes like cyber-fraud and online betting, which demand sophisticated investigative methods. The agency is also addressing judicial bottlenecks by advocating for exclusive PMLA courts and revising operational protocols.

4. Why was the ED’s 32nd quarterly conference held in Srinagar, and what were the key outcomes?

The ED’s 32nd quarterly conference, held in Srinagar from September 12 to 13, 2025, was strategically chosen to restore confidence in Jammu & Kashmir’s security environment following a terrorist attack in Pahalgam earlier in the year. The event’s success highlighted the region’s stability as a venue for national gatherings. Key outcomes included directives to fast-track PMLA trials, standardize cyber-fraud investigations, resolve PMLA-IBC conflicts, and enhance Foreign Exchange Management Act (FEMA) enforcement. The conference also emphasized technological upgrades, such as completing data entry in the ED’s case management system, and reaffirmed the agency’s commitment to integrity and excellence.

5. How is the ED addressing emerging threats like online gaming and cyber-fraud?

Following the Union government’s ban on real-money online gaming, the ED announced “focused strategies” to investigate money laundering through these platforms. The agency is strengthening its approach to cyber-fraud and online betting, recognizing the technological complexity of these crimes. During the Srinagar conference, robust cases in these domains were acknowledged, with directives to systematize investigative methods and evidence compilation. These efforts aim to counter the growing use of digital platforms for laundering, ensuring the ED remains agile in tackling modern financial crimes.