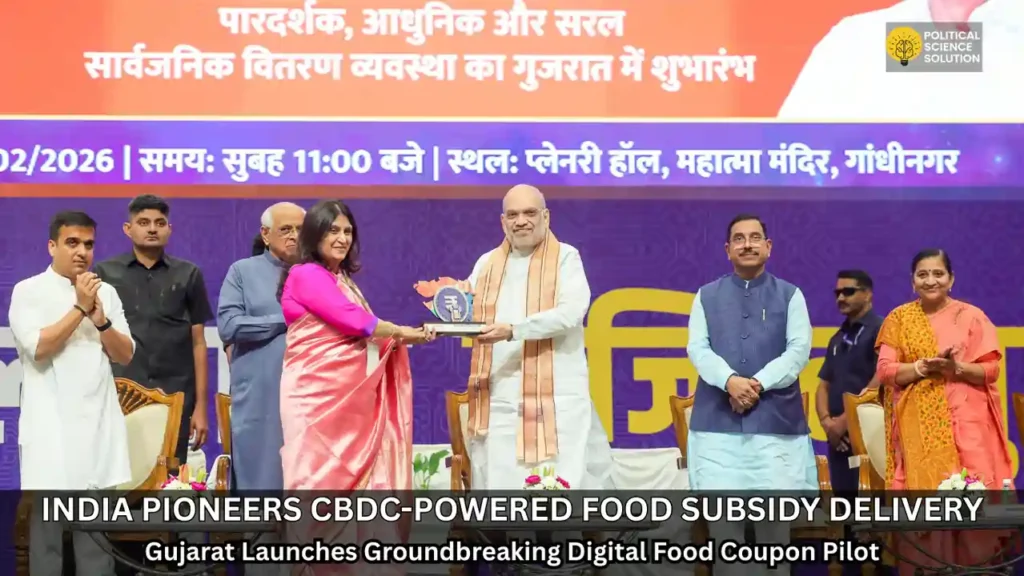

New Delhi: On February 15, 2026, Union Home Minister Amit Shah formally inaugurated India’s inaugural pilot integrating Central Bank Digital Currency (CBDC) into the Public Distribution System (PDS) at Mahatma Mandir in Gandhinagar, Gujarat. This pioneering effort introduces programmable digital rupees (e₹) directly into beneficiaries’ wallets for redeeming subsidized foodgrains, aiming to eliminate longstanding inefficiencies and corruption risks in one of the world’s largest welfare networks.

The event drew high-profile participation from Union Minister for Consumer Affairs, Food and Public Distribution Prahlad Joshi, Gujarat Chief Minister Bhupendra Patel, Minister of State Nimuben Jayantibhai Bambhaniya, Deputy Chief Minister Harsh Sanghvi, state Food and Civil Supplies Minister Ramanbhai Bhikabai Solanki, Minister of State Poonamchand Chhanabhai Baranda, Gandhinagar Mayor Meeraben Patel, and senior representatives from the central government, Gujarat administration, and Reserve Bank of India (RBI).

Minister Joshi Highlights Empowerment Through Technology

Prahlad Joshi described the rollout as a pivotal advancement in modernizing India’s PDS, which supports more than 80 crore citizens with essential subsidized commodities. He stressed that ongoing technological upgrades have steadily strengthened the framework, and this CBDC integration represents the latest leap forward. Joshi coined the powerful slogan “Har Dana, Har Rupiya, Har Adhikar” — Every Grain, Every Rupee, Every Right — to emphasize heightened beneficiary awareness, streamlined access, and reinforced accountability in subsidy distribution.

How the Programmable Digital Rupee Transforms Ration Access

At the core of the pilot lies the RBI-generated digital coupon system. Eligible households receive programmable e₹ credits straight into RBI-issued digital wallets. These funds remain restricted exclusively for purchasing authorized foodgrains at designated Fair Price Shops (FPS).

Redemption occurs via simple QR code scans or dedicated coupon/voucher codes at the shop counter. Transactions process instantaneously, producing an unbreakable real-time digital audit trail. This setup overcomes persistent hurdles such as frequent biometric failures and e-POS malfunctions, while guaranteeing secure, fully traceable exchanges. Dealers benefit too, receiving their commission margins credited in real time, fostering a balanced and mutually supportive supply chain.

Pilot Coverage and Initial Beneficiary Reach

The scheme debuted across four Gujarat districts: Ahmedabad, Anand, Valsad, and Surat. Early coverage includes more than 26,000 families — with specific mentions of around 26,333 households in Ahmedabad’s Sabarmati zone and additional participants spread throughout the selected areas. Beneficiaries access digital tokens specifying exact commodity types, quantities, and subsidized prices, enabling hassle-free collection without traditional paperwork or repeated identity checks.

Amit Shah Ties Initiative to Broader Digital India Goals

Amit Shah positioned the launch as a natural extension of the Digital India campaign into everyday welfare mechanisms. He celebrated India’s leading position in worldwide digital payments — accounting for nearly half of global volume — and expressed optimism that CBDC adoption would render the PDS entirely free of corruption and diversion. Shah urged remaining states and Union Territories to embrace the model swiftly.

He also defended government policies on international trade, asserting robust safeguards for farmers, livestock keepers, and fisherfolk in agreements with the United States and European Union, directly refuting opposition criticisms.

Parallel Initiatives Unveiled During the Ceremony

The occasion featured additional advancements in food security infrastructure. Shah remotely commissioned the innovative Annapurti Grain ATM in Ahmedabad, capable of dispensing up to 25 kilograms of grain within 35 seconds for round-the-clock convenience. He also kicked off the Suposhit Garudeshwar campaign targeting malnutrition reduction in Narmada district.

Two significant memoranda of understanding were exchanged with CARE Ratings and the Consumer Education and Research Centre (CERC) to reinforce consumer safeguards and overall transparency within Gujarat.

Planned Expansion to Union Territories

Officials confirmed rapid scaling beyond Gujarat. The next rollout phases will target Chandigarh, Puducherry, and Dadra & Nagar Haveli and Daman & Diu, allowing evaluation across varied urban and semi-urban environments with differing ration shop densities.

Building on a Decade of Digital PDS Reforms

This CBDC layer caps years of progressive digitization within India’s food security apparatus. Milestones include complete ration card computerization, nationwide One Nation One Ration Card portability, Aadhaar-linked e-POS terminals capturing live transactions, the Rightful Targeting Dashboard for analytics-driven eligibility checks, Ann Chakra for supply chain enhancements, and Ann Sahayata for swift grievance handling.

By embedding programmable sovereign digital payments, the pilot enables tightly conditioned subsidy flows — ensuring funds serve only intended purposes like foodgrain purchases — thereby sharpening Direct Benefit Transfer precision and supporting smoother monetary policy execution.

Understanding CBDC: The Foundation of This Innovation

Central Bank Digital Currency constitutes a fully digital equivalent of physical fiat money, issued and overseen by the RBI. Recognized as legal tender and carried as a central bank obligation per Section 26 of the RBI Act, 1934, it mirrors conventional rupee denominations. India commenced CBDC trials in December 2022, separating wholesale (e₹-W) interbank applications from retail (e₹-R) public usage.

Broader Implications for Inclusion and Governance

Incorporating CBDC into PDS promises substantial gains in financial access for underserved communities via RBI-managed wallets and direct entitlement transfers. The immutable ledger minimizes opportunities for graft, revenue leakage, or misallocation. Conditional programmability refines subsidy targeting, elevates administrative efficiency, and advances equitable resource distribution.

A Vision for Corruption-Free, Citizen-Focused Welfare

This Gujarat pilot stands as a bold demonstration of how frontier technology can harmonize with social justice objectives. By curbing systemic vulnerabilities and empowering end-users, it lays groundwork for a revamped, responsive, and integrity-driven food security model. As expansion unfolds, success here could reshape subsidy mechanisms nationwide, guaranteeing that every subsidized grain reaches its rightful recipient through secure, efficient, and transparent channels.

FAQs

1. What is the CBDC-based Digital Food Coupon Pilot, and why was it launched?

The pilot integrates the Reserve Bank of India’s Central Bank Digital Currency (CBDC), or programmable Digital Rupee (e₹), into the PDS to deliver food subsidies more transparently and efficiently. It credits digital coupons directly to beneficiaries’ RBI-enabled digital wallets, restricting their use solely to purchasing entitled foodgrains (like rice, wheat, pulses) at Fair Price Shops (FPS). Launched in Gujarat to combat leakages, reduce corruption, eliminate biometric and e-POS issues, and create real-time traceable transactions, it supports the government’s vision of beneficiary empowerment under the slogan “Har Dana, Har Rupiya, Har Adhikar” (Every Grain, Every Rupee, Every Right). This marks India’s first use of CBDC for PDS subsidy transfer, building on prior digital reforms like One Nation One Ration Card and e-POS devices.

2. Where is the pilot currently running, and who can participate?

The initiative started in four Gujarat districts: Ahmedabad, Anand, Valsad, and Surat. It initially covers over 26,000 families (including around 26,333 in parts of Ahmedabad like the Sabarmati zone). Eligible PDS beneficiaries under schemes such as the National Food Security Act (NFSA) and Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) receive programmable e₹ credits. The pilot targets a limited group after eKYC verification, with plans for rapid expansion to Union Territories including Chandigarh, Puducherry, and Dadra & Nagar Haveli and Daman & Diu to test it in diverse urban and semi-urban settings.

3. How do beneficiaries receive and redeem their digital food coupons?

Beneficiaries get monthly digital coupons as programmable e₹ credited straight to a dedicated RBI-issued digital wallet on their mobile phone (linked via Aadhaar, ration card, or registered mobile number, often with OTP authentication). To redeem:

• Visit a Fair Price Shop (or compatible Grain ATM).

• Scan the shop’s QR code or enter the coupon/voucher code.

• The system instantly transfers the value, dispensing the entitled foodgrains while generating a real-time digital record. This eliminates repeated biometric scans, fixes e-POS glitches, ensures secure transactions, and credits shop dealers’ margins immediately for a fair ecosystem.

4. What are the main benefits of using CBDC in the PDS?

Key advantages include:

Transparency and leak-proofing — Every transaction creates an immutable digital trail, reducing diversion, ghost beneficiaries, and corruption.

Efficiency — No need for repeated Aadhaar biometrics; faster, real-time processing improves last-mile delivery.

Programmability — Funds are locked for specific foodgrain purchases only, preventing misuse while enhancing Direct Benefit Transfer precision.

Inclusion — RBI wallets extend digital access to unbanked populations.

Accountability — Real-time monitoring benefits both beneficiaries (aware entitlements) and dealers (prompt payments), aligning with broader Digital India goals and Minimum Government, Maximum Governance.

5. What is CBDC, and how does it differ from regular digital payments or UPI?

Central Bank Digital Currency (CBDC) is a digital version of India’s fiat rupee issued and backed directly by the RBI (appearing as its liability under Section 26 of the RBI Act, 1934). It has the same legal tender status as physical cash, with identical denominations. Piloted since December 2022 (e₹-Retail for public use and e₹-Wholesale for banks), it differs from UPI or bank transfers because it’s sovereign money on a digital ledger — not a commercial bank’s promise. In this PDS pilot, programmability restricts usage (e.g., only for food at FPS), adding conditional controls absent in standard payments, while ensuring full traceability without intermediaries.